It is time to check in with debt market as we are starting to see yields stabilize. Although higher than we’d love to see, this relative stability is a welcome development for the health of the M&A market.

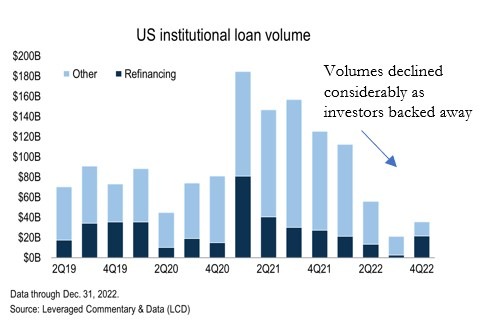

Leveraged Loan Volumes

The leveraged loan market experienced a significant pullback in volume in the second half of 2022, declining by 75% year-over-year in the third quarter, before showing a modest rebound in Q4. Beginning in July 2022, investors became almost feverishly concerned with rising inflation readings and the corresponding rate hike actions taken by the Federal Reserve to offset the inflation. As a result, a significant corner of the capital market – the debt market – collapsed, causing M&A transactions and refinancing activity to decline in lockstep.

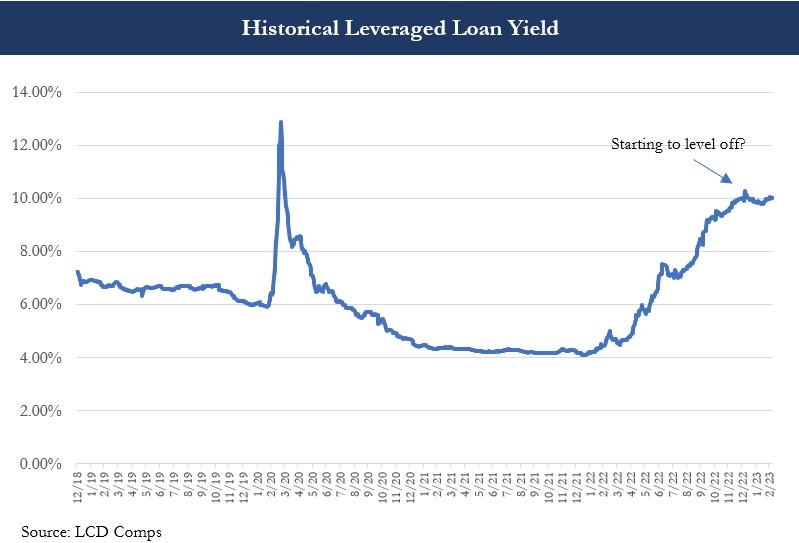

Interest Rates for Levered Loans

As traditional debt investors retreated, issuers needed to adjust their rate expectations to incentivize and attract these investors back into the market. Interest rates for leveraged loans then began their march upward very quickly and earnestly; leveraged loans that once were comfortably in the 6% yield area pre-pandemic and then near 4% yield area coming out of the pandemic rapidly widened out to greater than 10%.

Although yields today are elevated relative to historical levels, at least from the recent year to date trendlines, it appears the pricing is starting to stabilize. We expect this will lead to greater volume issuance now that prices appear to be sticking and expectations get reset. To the extent yields do stabilize as we expect, we can then expect to see a rebound in M&A transaction volume. We have said in the past, the M&A market can only thrive in a stable capital markets environment.

What does this mean for M&A?

For acquirers, the elevated interest rates will lower the amount of leverage that will be available from traditional debt investors – both bank and bond investors. This is primarily due to the fact that higher interest expense will lead to tighter cash flow coverage ratios, which means less debt can be issued to service the interest. The reduced leverage available from the debt market means acquirers will be more challenged to meet or exceed any valuation expectations of sellers, however realistic those expectations may be. Buyers may need creative structures to deliver on valuation hurdles or otherwise roll the dice and see if a lower cash multiple transaction would work.

Sellers, on the other hand, may need to adjust their valuation expectations to reflect the current capital markets environment if they are expecting a full cash-at-close transaction. For these sellers, they risk entering into an elongated and / or potentially turbulent road to close when holding out for a valuation multiple that may have worked more easily even just 18 months ago. The good news for sellers is that, while the multiple may not be as elevated as they once were, the investment opportunities and potential yields they can realize in the current market are significantly more attractive than comparable securities 18 months ago. All that said, some sectors are still so strong, with growth prospects every bit as compelling if not more so, that multiples are hanging in there.

Please reach out to us to get our honest read on your valuation and options.